Agent Recover

📀 Product Design

Riskified

The goal was to help merchants approve more borderline orders, boosting revenue and Riskified’s approval rates.

Riskified ensures that suspicious or borderline-declined orders can be verified and approved if determined to be legitimate. This is achieved through verification tools integrated into the shopping journey and by empowering merchant agents and customer service teams to manage complex order cycles.

The Issues & Opportunities

Key Objective

The system gives agents more control over orders, ensuring higher data accuracy and helping merchants improve their performance.

My Role

I built advanced platforms to help fraud agents manage workloads, support managers with performance insights, and keep checkout seamless for customers.

Challenge

Merchants struggle to recover borderline-declined orders, requiring varied solutions, from additional transaction details to authentication steps, across different industries.

Order approval split

Borderline Declines Trend

Research

Tailoring the Solution: Understanding business needs and flow, engaging in discussions with account managers and top merchants to identify their primary business concerns and interests. The aim of these conversations and user testing was to understand these critical business unknowns before proposing a solution.

Defining Personas

-

Mostly in charge of the team’s performance, approval rate, and chargeback rate

Riskified initiates targeted outreach to customers through personalized communication to encourage purchase completion.

-

Must be available for users facing difficulties with their orders and needs to provide answers and solutions quickly

-

Handles a high volume of borderline-declined orders, monitors their status throughout the purchase cycle, and, when necessary, contacts clients or overturns decisions from approval to decline.

Key Interests

What are you going to do with the information?

What are you measured by?

Within what timeframe can the recovery be made?

What integration does the merchant have: sync / async

Can you walk us through your daily tasks?

Which systems do you use?

How do you treat a borderline decline today?

Why are borderline declines important to you?

Agent (user) journey example

Agent (user) journey example

🕯️

In our research, we discovered that some merchants, like high-fashion retailers, contact shoppers after failed transactions to save orders and upsell, so we need to enable live order spotting with easy merchant access.

Solution

Part 1

Recovery-action agents can investigate an order and request a recovery action by providing additional information for a second analysis. If approved, the order status changes. If still declined, agents can override the decision, though Riskified won’t be liable for chargebacks.

Part 2

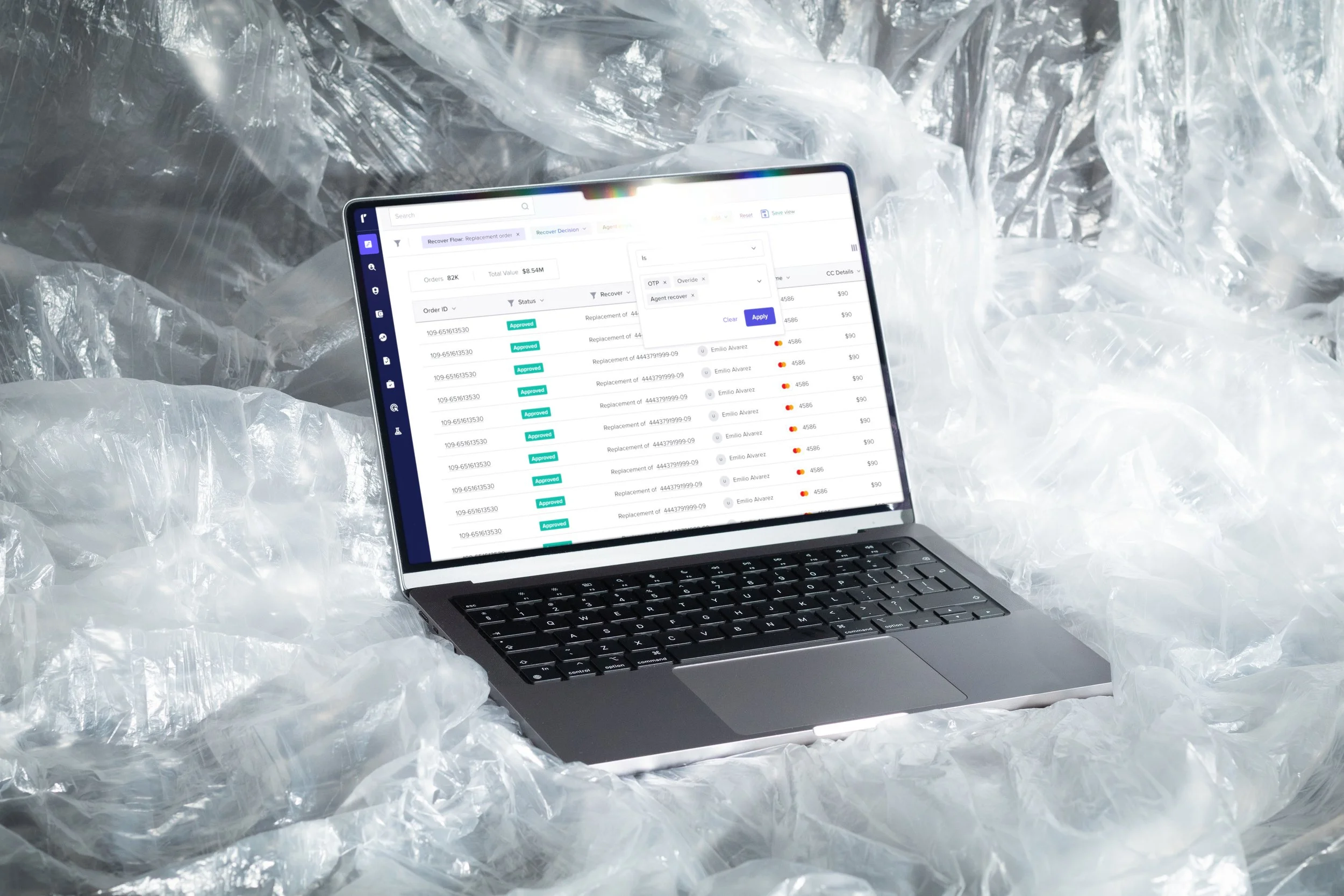

Track your recovered orders

Preset filters: allow users to quickly find orders critical for recovery, conversion, and additional actions.

Table columns: provide detailed, organized views for quick insights into recovery actions.

Notifications: ensure timely task completion by alerting agents to act within tight schedules, sometimes requiring customer outreach within specific timeframes

For a single order, users can view the order story for a deeper understanding. Additionally, a recovery tag—with a link to the new, replaced order - is presented at the page header.

Part 3

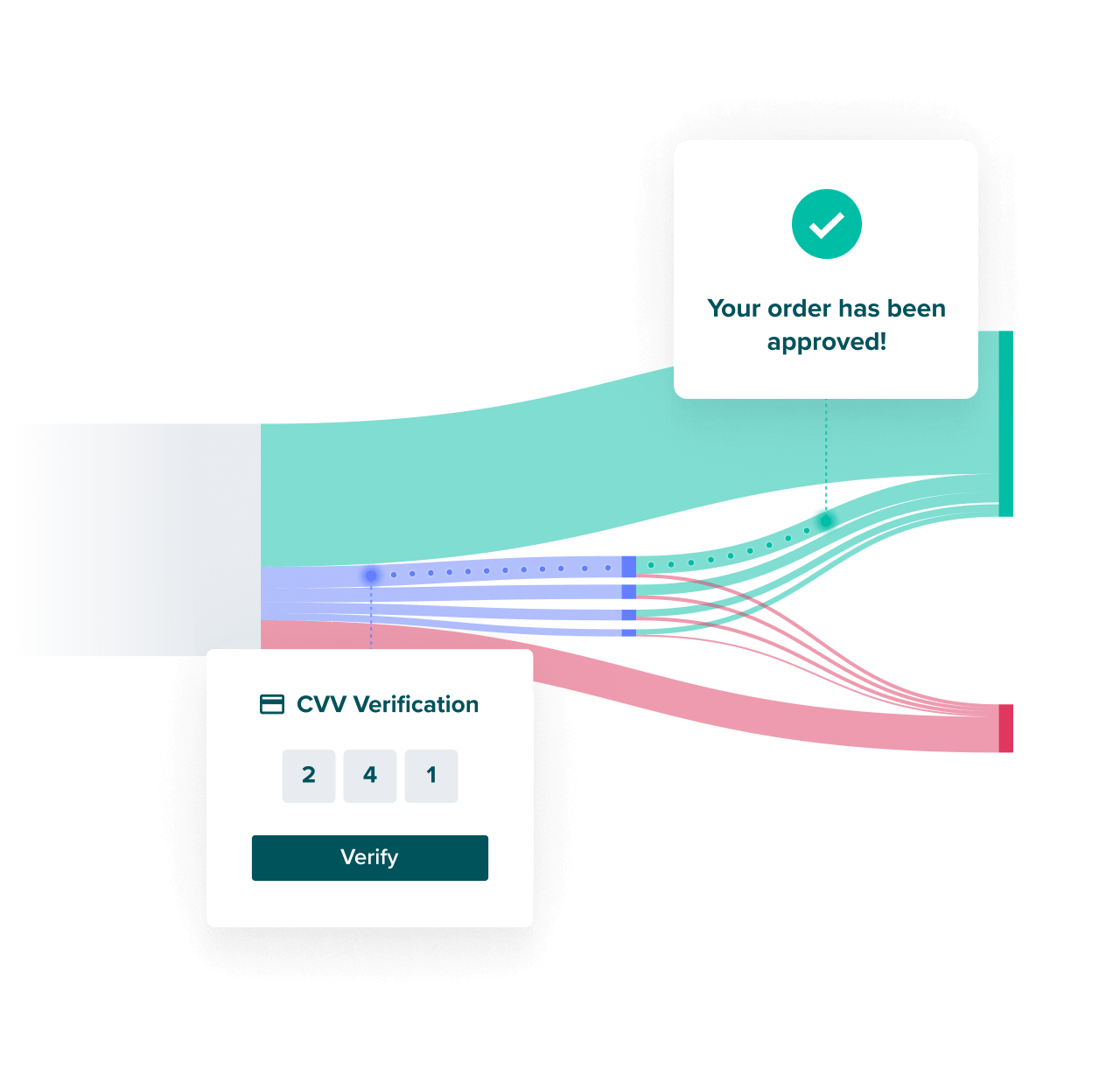

End-user checkout flow

While the agent’s side offers a wide range of options and supports complex workflows, the consumer experiences a simple, friendly, and seamlessly synced checkout with quick OTP verification.

Part 4

Next Steps

WIP

Automated checkout flows

Adaptive Checkout: a new product called Adaptive Checkout. This product provides merchants with real-time advice on recovery actions and authentication methods, aiming to increase conversion rates by 13%. It combines user-defined rules with Riskified’s advanced analytics that boost authorization rates.